How to Create a Customer Journey Map: AmFam’s 3 Steps To Success

American Family Insurance strives to create content that helps customers. See how they created a templated map for each customer segment.

How do you create a customer journey map? It can be as easy as 3 steps. This is something the marketers at American Family Insurance (AmFam) know well. When they realized they were losing out on customers, AmFam performed a serious content audit analysis to fill all of their content gaps and reach the customers they were missing out on.

How did they create a successful customer journey map and drive sales in the process?

We spoke with Ashley Mortimer , the Digital Experience Content Strategist at American Family Insurance (AmFam), to hear how her team built out a 12 month customer journey map in 3 steps.

How to Create an Insurance Customer Journey Map in 3 Steps

AmFam took the buyer’s journey process to the next level by following these 3 steps:

- Creating a skeleton template.

- Building out a 12-month timeline.

- Plotting customers on a roadmap.

They found their content gaps by not just creating one single customer journey map, but every potential customer journey to get a full view of their content landscape.

Step One: The customer journey map begins with a skeleton.

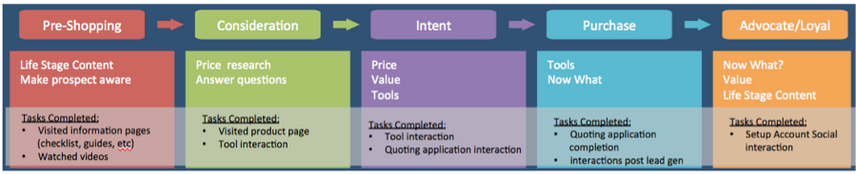

They created a template to start. Understandably, their various buyer personas will fit into their customer journey differently. But creating a template is a crucial first step to get started. Here is a single customer journey AmFam mapped to a “first-time homeowner” persona buying home insurance.

Their customer journey map is fluid and cyclical. The buyer's journey to purchase isn't always linear. After all, their buyers will often move from consideration to intent and then fall back into a consideration phase.

Think of the buyer's journey as never-ending. They can go left; they can go right. "They can go up; they can go down. Think of the journey from onboarding, to features, to filing a claim to having babies. And that's where we meet them, where their needs are. It doesn't matter what persona they are, we still need to give them the best experience.

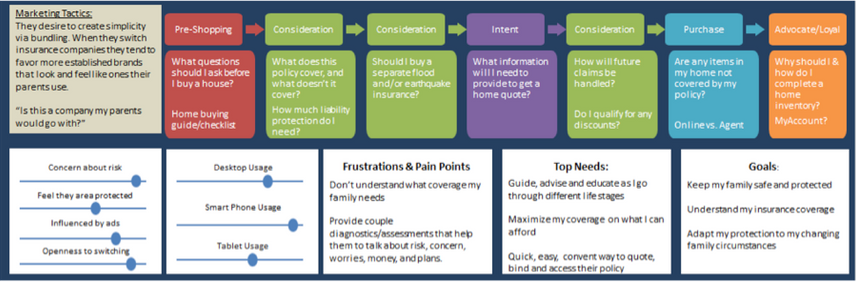

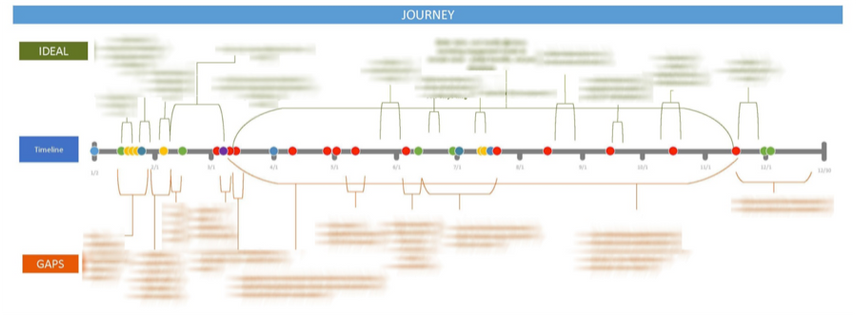

Step Two: After creating the customer journey map (each persona assigned a color), AmFam creates a 12-month timeline.

This timeline encompassed every AmFam persona, every buyer’s journey, and every touch point (including direct mail and email). Laid out above, each point on the customer journey map corresponds to a persona interacting with a different marketing initiative as they move closer to purchase.

AmFam then identified “gaps” in the content they were producing, and opportunities to create more content for those points on the timeline. But they realized that filling the content gaps wasn’t enough for a customer to complete a purchase -- AmFam also had to look at “ideal” content, which was customer-first content. This content catered to the customer's needs entirely, and sought only to help the buyer at that stage in their journey with whatever questions they may have had, even if that meant not pushing their product.

After a six-month process of creating personas and buyer’s journeys and pinpointing the content gaps and ideals, AmFam was ready to put that into a practical customer journey map.

Step Three: AmFam builds out a customer journey map.

Armed with a carefully planned road map, AmFam was ready to create content that could reach the right customers at the right time.

Creating Content That Helps Customers

Instead of focusing solely on highly competitive late stage terms like “auto insurance” and “renter’s insurance,” AmFam targets early and mid-stage keywords where there is high demand but less competitionCompetition

Businesses generally know who their competitors are on the open market. But are they the same companies you need to fight to get the best placement for your website? Not necessarily!

Learn more.

One example is their "Home Safety Inspection Checklist."

This checklist is an interactive, educational virtual tour of a typical house, which offers safety tips, a personal checklist, as well as a way to purchase safety accessories. The great thing about this piece is that it targets both an AmFam customer as well as a potential customer who is looking to make sure their house/apartment is protected. Essentially it targets anyone who is looking to protect their home.

This piece is jam-packed with a ton of valuable, early-stage content, and makes no mention of AmFam's products or a "Get a Quote" until a customer makes a more mid-stage or late-stage choice.

For example, like adding a "Talk with my Agent..." action item to a checklist as seen below:

Their content doesn't feel pushy, but informative. It helps the customer at every touchpoint answer the questions they need to have answered before they feel ready to move forward. And that's the secret behind their success.

Take the Long Journey with Content

AmFam’s example doesn't necessarily focus on a problem – they care more about answering questions and helping the customer. If it doesn't focus on the customer and the customer journey, the AmFam team won’t work on it.

But we can't ignore the bottom line. Which begs the question: will the AmFam customer make it to the end of the funnel? Is this early-stage content really enough to complete the buyer’s journey?

Ashley Mortimer believes yes. “We're not only trying to get a lead. We're trying to help somebody. We're trying to provide them with the information that they need. If we're there three times to help them, and they’re finally ready to make a purchase, they won’t need to consider anybody else. They're going to consider us.”

![Ashley Mortimer, Senior Manager at CONNECT by American Family Insurance, [object Object]](https://cdn.sanity.io/images/tkl0o0xu/production/5309bfb9ca10149d252e46e3d1851d2c77f8bce9-317x317.jpg?fit=min&w=100&h=100&dpr=1&q=95)